On 31 July 2023, the European Commission published the first set of the European sustainability reporting standards (ESRS). This is the first big step towards the implementation of the Corporate Sustainability Reporting Directive (CSRD), which came into force in January 2023. The CSRD calls for uniform and binding EU standards for sustainability reporting to be introduced through delegated acts. Now the Commission has published the first set of cross-sector regulations and has released a Q&A, dated 31 July 2023, with a range of background information. Sector-specific regulations and standards for SMEs and companies from third countries will follow in further sets to be released by June 2024.

The following article provides an overview of the ESRS and the consequences the regulations will have on the implementation of the sustainable finance regulatory package.

Who must apply the first set of the ESRS

The first set of the ESRS will initially apply to large publicly traded companies with more than 500 employees, certain financial institutions and insurance companies that are currently required to report under the Non-Financial Reporting Directive (NFRD) and will be required to report under the CSRD, starting in the 2024 financial year. For all other companies subject to the CSRD, the ESRS will gradually become applicable. As of the 2025 financial report, the new reporting standards will also apply to all other large companies. Beginning with the 2026 financial report, publicly traded SMEs will be required to report according to separate graded standards, which are to be adopted by the Commission by the end of 2024. Alternatively, they can also opt for a deferral until 2028.

The first set of the ESRS

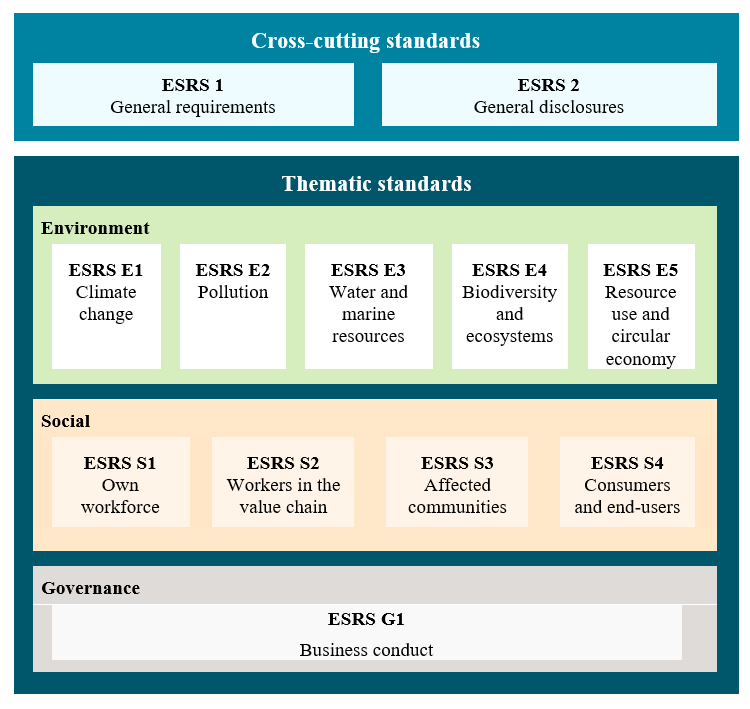

The first set consists of two cross-cutting standards that apply to all sustainability topics and ten topic-specific standards on Environmental, Social and Governance matters. The following graphic provides an overview:

Materiality principle as the foundation for sustainability reporting

The European Financial Reporting Agency Group (EFRAG) was commissioned to complete the technical preparation of the ESRS drafts. The final version now published by the European Commission differs significantly from the EFRAG draft. These changes are intended to reduce the burden on the companies concerned.

All ESRS standards, with the exception of ESRS 2 "General disclosures", are subject to the materiality condition. ESRS 1 implements the principle of double materiality, which is enshrined in law in the CSRD.

According to the CSRD, a sustainability issue is material and thus subject to reporting if it relates to significant actual or potential effects of the company on people or the environment (impact materiality), or if it has or can have significant financial effects on the company in the short, medium or long term (financial materiality).

Reporting obligations in connection with the EU sustainable finance regulation

The EFRAG's drafts provided that reporting requirements in the context of EU legal texts, such as on principal adverse impact (PAI) indicators under the Sustainable Finance Disclosure Regulation (SFDR), the Benchmark Regulation or Pillar 3 requirements under the CRR, should always be considered material and must be reported.

In contrast, the Commission's drafts provide for a materiality condition. This means that companies must only report key performance indicators (KPIs) and other data on a specific sustainability topic if they are material to the company regarding either impact materiality or financial materiality. This also applies to information about PAI indicators under the SFDR, which financial market participants are obliged to disclose.

Financial associations have criticised the drafts for threatening financial market participants with a data gap – they may be required to report information on PAIs under the SFDR while target companies, citing lack of materiality, may not be required to report. The Commission argues that the CSRD provides for an external check on reporting, which includes the materiality analysis and thus ensures that material sustainability issues are reported on.

In response to the criticism of the draft, an explicit statement must now be published if the information in question is related to the SFDR, Benchmark Regulation or Pillar 3 requirements under the CRR. If the company does not consider the information to be material, it must state this explicitly. It cannot simply report no information. In addition, companies must submit a spreadsheet with all these data points.

Concerns alleviated regarding reporting obligations on PAI indicators

In its Q&A, the Commission announces further specifications related to the SFDR and other subjects. In addition, it alleviates the concerns of financial market participants and financial advisors regarding the data gap mentioned above. These persons are allowed to assume that each indicator reported by a company as non-material does not contribute to the corresponding PAI indicator within the scope of the SFDR disclosures.

The European Parliament and the Council of the European Union may raise objections to the act within a period of no more than four months. If there are no objections, the act will be published in the Official Journal of the EU and will take effect.

For more information on the implementation of the CSRD, contact your CMS client partner or these local CMS experts.

Social Media cookies collect information about you sharing information from our website via social media tools, or analytics to understand your browsing between social media tools or our Social Media campaigns and our own websites. We do this to optimise the mix of channels to provide you with our content. Details concerning the tools in use are in our privacy policy.