On 12 March 2024, the Department for Energy Security and Net Zero (“DESNZ”) published the long awaited second consultation wide-range of reforms that the UK Government has proposed to make to the GB electricity market through the Review of Electricity Market Arrangements (“REMA”)(the “Consultation”).

This follows the first consultation (the “First REMA Consultation”) published in July 2022 (which we reported on here). The summary of responses for the First REMA Consultation highlighted a general consensus among respondents regarding the necessity for market reform, however as previously reported here, it lacked clarity on the proposed options for effecting change.

The key headlines of this latest Consultation include a focus on zonal pricing and an emphasis on unabated gas generation. We set out below the four key challenges that DESNZ is seeking to address in this Consultation and the key considerations for industry participants.

This Consultation closes on 7 May 2024. Details of how to respond, as well as the full text of the consultation is available here.

The Case for Change

The case for change, as set out in the First REMA Consultation, outlined key challenges that the future electricity system will encounter as it transitions towards a renewables-dominated landscape. These challenges include: the need for increasing investment, enhancing system flexibility, providing efficient locational signals, retaining system operability, and managing price volatility. DESNZ concluded that the existing market arrangements could not deliver its ambitions for a cost-effective, decarbonised and secure electricity system by 2035, or effectively deliver the UK Government’s 2050 net zero ambitions.

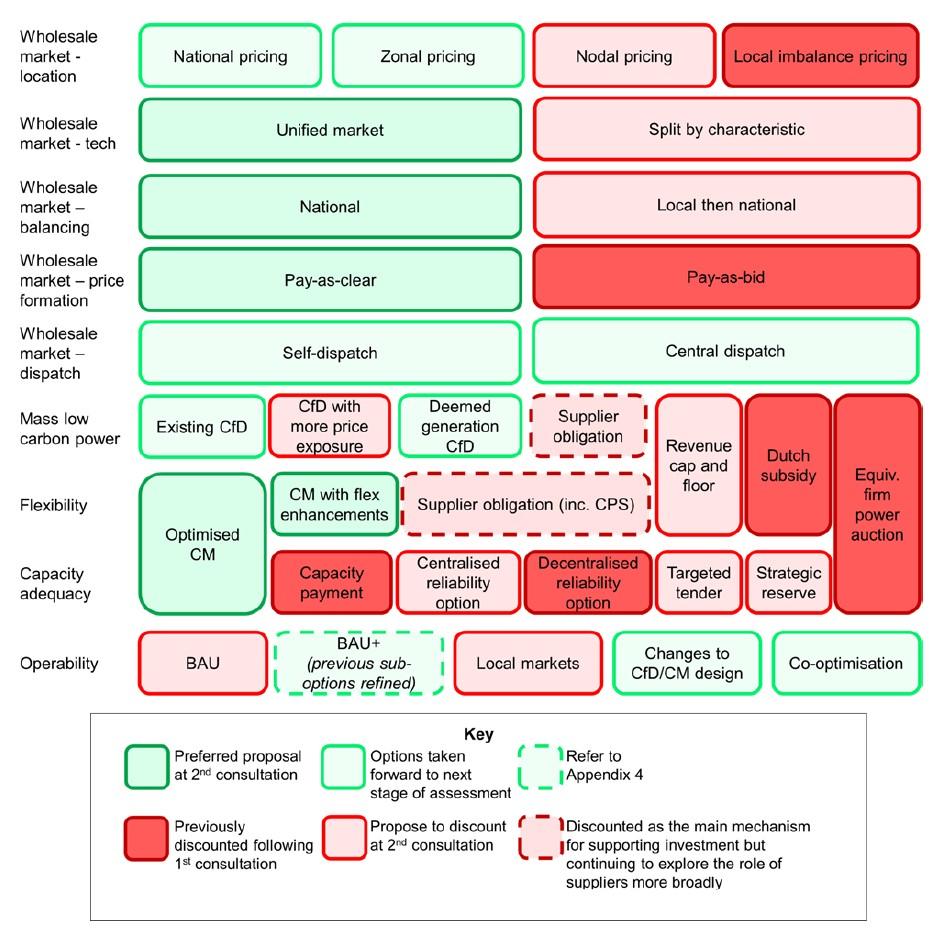

Since the First REMA Consultation, DESNZ has developed an Options Assessment, an overview of the REMA policy development process for shortlisting policy options. Currently the options focus on maintaining a unified wholesale market, enabling further investment into renewable generation, optimising the capacity market mechanism, and introducing zonal pricing. DESNZ’s challenge-led approach is aimed at significantly narrowing down the remaining options to reform the electricity markets, whilst recognising that the next phase will require development of a whole-system solution.

Source: Figure 2, Review of Electricity Market Arrangements, Second Consultation Document

The updated case for change is now based around the following four key challenges and associated questions:

| Challenge | Questions |

| Challenge 1: Passing through the value of a renewables-based system to consumers | - How best to decouple gas and electricity prices to pass through the benefits of renewables to consumers, and what is the role of marginal pricing within electricity markets?

- How can Corporate Power Purchase Agreements (CPPAs) benefit different consumers and developers of low carbon capacity, and how might this role evolve?

- How do we best incentivise electricity demand reduction from consumers, and what is the role of markets in doing this?

|

| Challenge 2: Investing to create a renewables-based system at pace | - How to de-risk investment in renewables while increasing operational risk exposure to deliver lowest overall system cost?

|

| Challenge 3: Transitioning away from an unabated gas-based system to a flexible, resilient, decarbonised electricity system | - How do we maintain security of supply in a future electricity system dominated by intermittent renewable generation?

- How do we manage a smooth transition away from unabated gas to low carbon flexible technologies?

|

| Challenge 4: Operating and optimising a renewables-based system, cost-effectively | - How do we maintain security of supply in a future electricity system dominated by intermittent renewable generation?

- How do we manage a smooth transition away from unabated gas to low carbon flexible technologies?

|

As a reminder, each option will be considered through the lens of the REMA assessment criteria:

- Value for money – solutions that minimise overall system costs and drive innovation;

- Deliverability – changes should be achieved within the designated timeframes and minimise disruption during the transition;

- Investor confidence – significant investment in a full range of low carbon technologies with risks passed to those who are best placed to manage them;

- Whole-system flexibility – incentivise market participants of all sizes to act flexibly and coordinate across traditional energy system boundaries; and

- Adaptability – respond to change to ensure optimal delivery of Government objectives.

Challenge 1: Passing through the value of a renewables-based system to consumers

Challenge 1 looks at how the value of a renewables-based system can be passed through to consumers. The First REMA Consultation initially explored alternative structures like the Green Power Pool (“GPP”) and the Split Market, but resolved that they were impractical due to design challenges and limited benefits compared to the existing system. These were novel models that carried extensive delivery and implementation risk, with a particular concern that the benefits could ultimately accrue to intermediaries in the market instead to the intended recipients (i.e. the end consumers).

The Government has proposed to continue with current market arrangements by retaining marginal pricing across the wholesale market, with the intention of further amending the Contracts for Difference (“CfD”) scheme as a whole (rather than on a per allocation round basis) – see Challenge 2 below. The CfD scheme aims to lower the period of time that unabated gas settles the marginal price in the market, with the Higher Demand Scenario predicting that unabated gas will be used to set the market price for less than 5% of the time by 2035. In such a scenario, it is anticipated that there will be prolonged periods of low wholesale market prices in the future (where renewables set the marginal price). The Government also highlights that with more generation subject to CfDs, this will in effect decouple gas and electricity prices to costs to consumers (as the pass through to consumers is limited with CfDs). For completeness, voluntary CfDs have been ruled out on the basis that there is not a strong case that these would offer value for money and lower consumer bills.

Corporate power purchase agreements (“CPPAs”)

In the First REMA Consultation, DESNZ considered the UK Government’s active facilitation in the growing CPPA market in the UK. Whilst the Government has now rejected options for direct Government intervention, it will continue monitor the evolution of the CPPA market, and encourages respondents to consider the impact of REMA reform on CPPA markets. The Government also confirmed that it is currently reviewing the REGO scheme and how REGOs can complement future-proofed CfDs and CPPAs to drive investment in renewable generation.

The Consultation noted several market barriers to the growth of CPPAs: (1) high counterparty risk, (2) high transaction costs, and (3) contract length/demand mismatches. All of these are issues that the market is dealing with on an ongoing basis – and while new counterparties entering the market and the flexibility in contracting are helping to mitigate some of these challenges, the availability of good projects to match demand, volatility in prices and regional challenges are persistent obstacles to the growth of the CPPA market.

Demand reduction

Although respondents to the First REMA Consultation supported demand reduction, opinions varied on whether it should be market-driven or policy-based. Identified barriers included a lack of clear signals and the undervaluing of benefits in the market.

The Government plans to address these challenges by sharpening price signals, strengthening energy efficiency policies, and promoting retail market innovation. The focus will be on enhancing existing policies and retail market reforms – market-based models were considered but discounted due to their complexity.

Challenge 2: Investing to Create a Renewables-based System at Pace

Key Challenges

Whilst this Consultation confirms the Government’s continued support for a future-proofed CfD-type scheme, it highlights the following challenges for the current CfD scheme:

- Scaling up renewable investment – the current CfD scheme does not protect against the increasing ‘volume risk’ (where increased renewable generation leads to increased periods where electricity supply exceeds demand);

- Maximising asset responsiveness - current CfD design elements introduce operational and investment issues that may escalate with increased CfD assets. Operational inefficiencies may incentivise maximum generation regardless of market conditions and create expensive cliff-edge effects (‘herding behaviours’), while investment signals are skewed by fixed strike prices; and

- Distributing risk effectively - historically, the CfD scheme shielded investors from electricity price fluctuations by providing a fixed price for output. However, uncertainties in electricity sales due to weather or the inability to secure an offtaker, continue to pose risks for generators.

Scope of CfD Reform

Following the First REMA Consultation, the Government resolved to reforming the existing CfD scheme (rather than replacing it entirely). The Government has since dropped the following two options for CfD:

- a strike price range - this was dropped on the on the basis that it would introduce significant extra risk for developers, whilst potentially having limited system benefits; and

- a revenue cap and floor - this had several design flaws that could lead to significant gaming risk or distort incentives for generators to operate efficiently, causing a detriment to consumers. The Government recognised the tension between (a) de-risking investment and (b) increasing incentives to maximise responsiveness to system needs.

Several remaining options are being considered, including:

- Deeming CfD Payments - involves estimating an asset's potential generation under live conditions and replacing the actual metered output with deemed output. This would require a deeming methodology, where subsidy difference payments could be determined by the deemed output. This comes with challenges such as: how is such a methodology created and how will it be kept accurate and updated? This is especially true as there has been recent speculation on the accuracy of estimating output feeding into the Government’s concerns about gaming risk and overcompensation;

- Capacity-based CfD - proposes fixed payments to generators based on installed capacity, independent of market activity. This would allow the generator to operate on merchant terms to optimise trading and operational strategies across markets;

- Partial CfD Payments - proposes covering only a portion of a renewable asset's capacity under a CfD, with the remainder operating on a merchant basis; and

- CfD Reference Price Reform - explores options to increase price exposure of intermittent renewable CfD assets, aiming to prompt generators to be more responsive to market needs. However the potential interactions with other factors such as the potential increase in the cost of capital need to be considered.

In relation to the deemed payments or capacity payments, the Consultation confirmed that, if implemented, these would only apply to CfDs awarded in future auctions.

The Government has not shared a preferred CfD reform option, as it’s decision will depend on other REMA decisions, especially in relation to wholesale market reform and locational pricing. DESNZ recognises that the next phase of REMA will be to conduct a more detailed assessment of remaining CfD reform options to identify a preferred one by mid-2025. In addition, there are ongoing CfD reforms, including expanding the scope of the CfD to support repowering, and to improve renewable site flexibility and grid operability.

Challenge 3: Transitioning away from an unabated gas-based system to a flexible, resilient, decarbonised electricity system

Retention of the Capacity Market (CM)

The Government intends to retain an optimised CM as a primary mechanism for ensuring capacity adequacy. A range of other options, including cross-technology revenue cap and floor, centralised reliability options, strategic reserve, and a targeted tender, have been discounted on the basis of being less effective.

Of the three auction design options considered, the Government intends to take forward the single auction with multiple clearing prices option for the CM (referred to as the “Optimised CM”). This involves introducing a minimum procurement target for desirable characteristics (otherwise known as ‘minima’) into the auction to better support investment in low carbon flexible technologies. This Consultation seeks views on the proposal to reform the CM through the Optimised CM design.

In addition to the auction design, Government is working on other aspects of the CM to ensure the changing nature of security of supply. These are: (a) auction targets, (b) strengthening the CM rules, (c) considering further changes to mitigate risks to security of supply, and (d) ensuring the reliability standard is fit for purpose. In relation to the last one, Government is considering whether the current standard of 3 hours Loss of Load Expectation requires reconsideration as the nature of future stress events is likely to change.

Long-Duration Flexibility

The Government also highlights that long-duration flexibility is essential for stability and security of electricity supply where renewable generation cannot meet demand. See our LawNow here on the recent consultation. The Government is working to support the deployment of low carbon long-duration flexibility through the use of technologies such as Power with Carbon Capture, Usage and Storage CCUS (“Power CCUS”), Hydrogen to Power (“H2P”) and Long Duration Electricity Storage (“LDES”), to guarantee the security of supply during the transition from unabated gas to a fully decarbonised electricity system as gas capacity nears its end of life. Power CCUS utilises CCUS technology for electricity generation, whilst H2P aims to convert low carbon hydrogen to produce low carbon electricity, and LDES looks to store excess renewable generation over longer periods of time.

New Gas Generation

Whilst low carbon long-duration alternatives are being rolled out, the Consultation and official press release both highlight the Government’s anticipation that unabated gas will continue to be required until at least 2035. Government proposes a limited amount of new gas capacity for system security purposes (gas currently being the only technology capable of providing sustained flexible capacity). The Consultation seeks inputs on the difficulties associated with transforming existing unabated gas plants into low carbon alternatives.

Challenge 4: Operating and optimising a renewables-based system, cost-effectively

Challenge 4 focuses on reconfiguring market arrangements with a view to maintaining secure electricity supply in the transition to a predominantly renewables-based system. In the First REMA Consultation, DESNZ sought feedback on the initial options they proposed to address the challenges associated with keeping the electricity system operating dependably and at low-cost during the transition. This Consultation narrows down the options for reform to improving: locational signals, temporal signals, balancing and ancillary services, local and national market co-ordination and market liquidity.

Locational Signals

As the UK transitions to a low carbon electricity system, Government considers that improved locational signals will help manage the current strain on the network infrastructure. The Consultation proposes two sets of market-based options to tackle the current challenges of receiving efficient and accurate price signals.

Zonal pricing

- The zonal pricing option aims to send wholesale market participants both locational investment and operational signals. This is expected to provide a wide set of benefits, including: a more efficient system, lower consumer bills, a potential to maximise whole-system flexibility and drive economic growth. However, the Consultation sets out that this option may carry greater implementation risks, such as: potential increases in the cost of capital application challenges due to complexity of the system, impacts on liquidity, and a requirement to adapt the zonal markets over time so that they reflect the system constraints.

Locational investment signals outside the wholesale market

- The second option is a set of alternative options, which aim to primarily send locational investment signals outside the wholesale market. This includes working with Ofgem to re-purpose it’s pre-existing network charging reform programme and review Ofgem’s transmission network access arrangements. It also includes options to expand measures for constraint management and optimise the use of cross-border interconnectors. The Consultation states that this second proposal could be implemented under current national pricing arrangements and would carry lower implementation risk for investors. However, this option may require combining options in order to reach the desired impact and will still require significant reforms, such as changes to access rights arrangements.

Separately, the Government has discounted the previously considered nodal pricing model due to the impacts it would have on investor confidence and the deliverability of the 2035 decarbonisation targets.

Improving Temporal Signals

With the increase of intermittent generation and rising electricity demand, the Consultation considers two options to improve temporal signals. Firstly, introducing shorter settlement periods to create more granular wholesale market temporal signals, and secondly, introducing tighter gate closure intervals to ensure Final Physical Notifications (“FPNS”) are based on information closer to real time positions. In light of the desired implementation timeframes, the Government has opted to progress the shorter settlement periods option.

Balancing and Ancillary Services

The Consultation outlines that ESO is currently facing a number of challenges in balancing the system, including: managing balancing issues which occur across consecutive settlement periods, demonstrating clear-decision making across a range of operational needs, and issues with the self-dispatch design. ESO is conducting an ongoing assessment of reform to dispatch arrangements, the results for which are expected in Spring 2024.

Alongside ESO’s assessment, the Consultation recognises that to improve system balancing and the operational efficiency of the market, centralised dispatch will be continued alongside a reformed Balancing Mechanism to target increasing competition and transparency. The Consultation mentions a ‘self-commit’ option where generators schedule their own units, the system operator issues dispatch instructions, and generators are compensated for deviations from their scheduled positions. This model could be adopted in both national and zonal pricing scenarios.

The Consultation also recognises a need to reform the Balancing Mechanism to address the rising number of challenges in balancing the system, such as skip rate and dispatch transparency, improving baselining methodologies for Demand Side Response, simplification to improve revenue stacking, lowering participation thresholds, and introducing closer to real-time procurement.

Local and National Co-ordination

In consideration of improving local and national coordination, the Government has decided to discount the ‘local markets’ model (which aimed to reorient the wholesale market around local, distribution-level markets) opting to consider instead what further actions are needed in order to deliver open, dynamic and coordinated markets for distributed low carbon flexibility, as discussed in Challenge 3.

Next Steps

Looking forward, REMA discussions are likely to remain focused on zonal pricing and maintaining national pricing combined with options to sharpen locational signals, as well as narrowing down the proposed reforms to CfDs, the CM and balancing services. Clearly the REMA reforms are not in a vacuum and concerns remain about the ability of CfD (AR6) to deliver the additional capacity needed to meet the net zero targets. Measures proposed in this Consultation will not address these challenges or the need for greater planning and coordination of the grid systems to ensure there are connections (and consents) in place to meet the growing renewable energy generation be it supported by CfDs, capacity market or corporate PPAs.

This Consultation summary of responses is expected to be published in summer 2024. The Government aims to conclude the policy development phase of the programme by mid-2025 and move into full- scale implementation from 2025 onwards.

Whilst we seem to have a little more clarity on the Government’s proposed direction with REMA, this Consultation offers another opportunity for stakeholders to contribute to a more refined review of the potential reforms electricity market.

Social Media cookies collect information about you sharing information from our website via social media tools, or analytics to understand your browsing between social media tools or our Social Media campaigns and our own websites. We do this to optimise the mix of channels to provide you with our content. Details concerning the tools in use are in our privacy policy.